U.S.-China Confrontation Runs Counter to Both Countries’ Interests

China Today by JOHN ROSS, February 8, 2017 Adjust font size:

This inequality has become more pronounced since Reagan’s presidency in 1981. From 1980 to 2015, the bottom 20 percent of U.S. households’ share in the total U.S. income fell from a low of 4.2 percent to 3.1 percent. Simultaneously, the share of the top 5 percent of U.S. households in total U.S. income underwent a sharp 5.6 percent rise from 16.5 percent to 22.1 percent. Meanwhile, the share of each household income group in the bottom 80 percent of the U.S. population in total U.S. income showed a sharp 7.1 percent decline from 55.9 percent to 48.8 percent.

Given these dramatic and growing income disparities since 1980, the rising political instability in the U.S. is no surprise.

The fundamental economic reasons behind these negative trends in U.S. incomes are equally clear. Figure 1 shows that, when taking a 20-year moving average to remove all effects of short-term business cycle fluctuations, between 1980 and 2016 the annual growth of U.S. per capita GDP fell by half – from 2.6 percent to 1.3 percent. That this slow economic growth was accompanied by a radical increase in social inequality explains the fall in U.S. median household incomes.

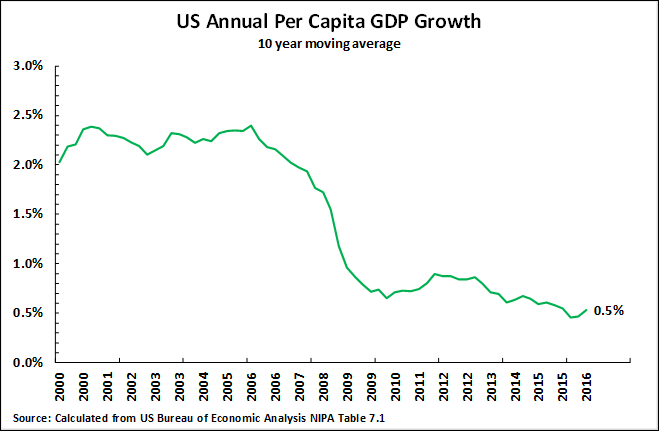

Recently, this slowdown in the U.S. economy has worsened. As Figure 2 shows, under the impact of the international financial crisis the 10-year moving average of annual per capita GDP growth in the U.S. had fallen to 0.5 percent – close to stagnation – by the second quarter of 2016. Such miniscule per capita economic growth made impossible any significant increases in the living standards of the American people.

A Win-win U.S.-China Economic Relationship

While, as analyzed below, foreign trade and investment are not main factors in the recent U.S. economic performance, the correlation of trade expansion and positive economic performance is nevertheless widely acknowledged – both theoretically and factually. Adam Smith said in the first sentence of the first chapter of his seminal work on modern economics The Wealth of Nations: “The greatest improvement in the productive powers of labor, and the greater part of the skill, dexterity, and judgment with which it is directed, or applied, seem to have been the effect of the division of labor.” The division of labor necessarily applies both internationally and domestically. Numerous factual studies have confirmed the positive correlation between economic openness and faster growth.

This economic conclusion is also confirmed, in the negative sense, by the world’s post-1929 relapse into the protectionism that presaged the Great Depression – the greatest economic crisis in modern world history. It was indeed this catastrophic experience that moved the U.S. after World War II to reverse its previous protectionist course and, for half a century, promote an open world trading order – one with great “win-win” benefits for both itself and other countries. Globalization brought great benefits to economies – not only to the U.S. but also to China in the wake of its reform and opening-up policy of 1978.