Six suggestions for China's embattled economy

china.org.cn / chinagate.cn by Zhang Ming, October 20, 2014 Adjust font size:

The macro economy in China seems to have run into new problems, which can be seen in the following aspects:

|

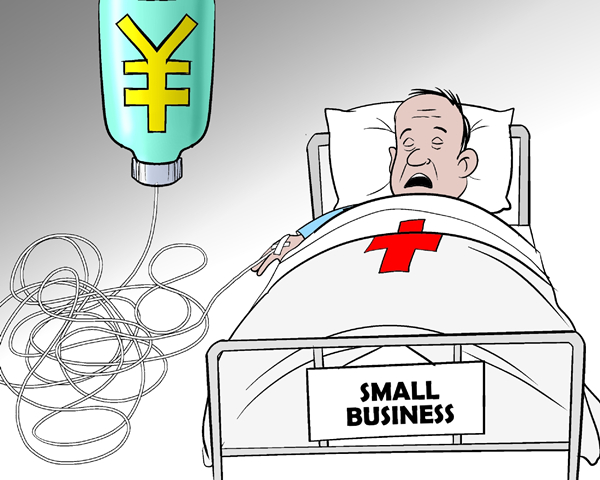

A long way to go [By Jiao Haiyang/China.org.cn] |

First, despite continuous attempts from the People's Bank of China to cut the costs of capital access for small-and-medium-size enterprises through loosening policies, the costs remain high and continue drain SMEs' assets. The policies are like torrents of sea water to thirsty people -- although the resources are plentiful, they are not drinkable.

Second, the Chinese government has been seeking equilibrium between sustainable growth and economic restructuring, but has made little progress as of yet. According to the High Frequency Data, the macro economy is still under pressure from a downward trend.

Third, despite the upcoming start of interconnection between the Shanghai and Hong Kong stock markets, the opening of pilot financial sectors such as the Shanghai Free Trade Zone and the Qianhai Special Economic Zone are moving at a slow pace. Meanwhile, short-term capital flows have been fluctuating significantly.

Fourth, without the closing of national-level deposit insurance companies, which was a precondition of the market reform of the Chinese yuan's interest rate, fears of slowing reform are growing in the market.

Fifth, the M2 (a measure of monetary supply used by the various central banks) and the growth of total social financing is plummeting. This should be partly attributed to the tightening of control by the supervisory body of the banking system accompanied by a substantial squeeze in off-balance-sheet credit. However, dwindling demand for financing cannot be excluded as another reason for the declining market.

The new difficulties facing China's macro economy have caused split views from scholars and policy makers on whether it is necessary to cut interest rates or benchmark interest. The supporters believe a cut would lower financing costs, which would in turn stimulate investment and consumption. However, those who oppose cutting interest rates hold the opinion that such an approach may not lower the financing costs of SMEs, but would rather flush massive fluidity into real estate and local government-run businesses, which would cause further damage to already unbalanced economic structures.