Transformers of industrial landscape

China Daily, August 11, 2014 Adjust font size:

The company is building a research and manufacturing hub in Guiyang, the capital of Guizhou.

Terry Gou, its chairman, said last month that its operations in the city's new industrial park were expected to generate revenue of 50 billion yuan in 2018.

In 2011, Foxconn revealed it planned to be using a million robots in its factories within three years, and to have its factories fully automated within a decade.

Some top Chinese home appliancebrands have also been employing robotic technology on a major scale.

Haier Group, the multinational electronics giant, is reported to have cut 18 percent of its workforce last year and will cut another 10,000 positions this year, due to its increased use of robots.

Midea, the privately held Chinese electrical appliance manufacturer, has also set up robot design and manufacturing teams, and already uses hundreds of robots on its production lines.

Noting the trend, the Chinese authorities have introduced policies to encourage more use of robotics.

In December, the Ministry of Industry and Information Technology issued guidelines for promoting the use of industrial robots.

And in June, at the 17th conference of the Chinese Academy of Sciences, the national institution conducting basic and applied research, President Xi Jinping stressed that "major robot manufacturers and countries are speeding up their market development, so our companies should also improve their robot-related skills".

In Qingdao, Shandongprovince, an industrial park has been set up dedicated to the robot sector. Opened in May of last year, it has attracted 30 companies and startups. Its target is 50 by 2016, generating output value of about 4 billion yuan.

"The robot industry is a way of promoting the whole city's industrial transformation and upgrade," says Geng Kai, deputy director of the Bureau of Investment Promotion at Qingdao National High-tech Industrial Development Zone.

"Qingdao has a good industrial foundation. Our machinery and equipment sector, which boasts many top appliance and foodbrands, had output exceeding 250 billion yuan last year. As a coastal city, we also have good natural conditions for developing marine-related robots that can work underwater."

Further south in Zhejiang province, known for exports largely dependent on low-cost labor, 36,000 local companies have stated that they plan to replace workers with machines by 2017, at a total investment expected to be more than 300 billion yuan.

Similar estimates have been published by officials in Guangdong province, the export manufacturing hub in the south of China, and in Jiangsu province, home to many of the world's leading exporters of electronic equipment, chemicals and textiles.

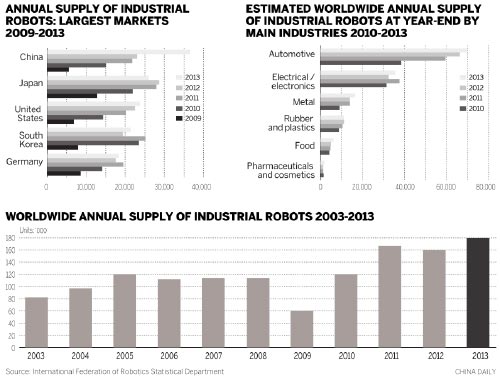

However, overseas-made robots still dominate. Of the 37,000 sold in China last year, only 9,000 were from Chinese suppliers. Local sales were three times higher than in the previous year, while the sales of foreign suppliers rose 20 percent, the China Robot Industry Alliance says.

But Japanese, European and US producers still accounted for the majority of major contracts, with Chinese products being targeted mostly at middle and low-end users.

"Robots made by Chinese suppliers still lag behind those made by international companies, in terms of quality, technical level and performance parameters," Song says.