Report: US$346 bln market for green bonds

chinagate.cn, July 15, 2014 Adjust font size:

The global market of bonds That are related to climate or green themes stands at $346 billion as of March 2013, according to a recent report released by Canada-based International Institute for Sustainable Development.

A bond does not have to be labelled as “green” or “climate” to finance such projects, although it does help investors who wish to allocate capital to those areas. Aside from development banks, there are many state-backed and corporate actors that are active in climate or green themes yet do not label their bonds as such.

The CBI (2013) conducts an annual review of domestic and international bond markets to measure the current amount outstanding in bonds dedicated to climate or green investment themes based on the activities of the bond issuers. The review serves to broaden the mindset of the investment community, which may regard green bonds as niche, lacking scale or liquidity.

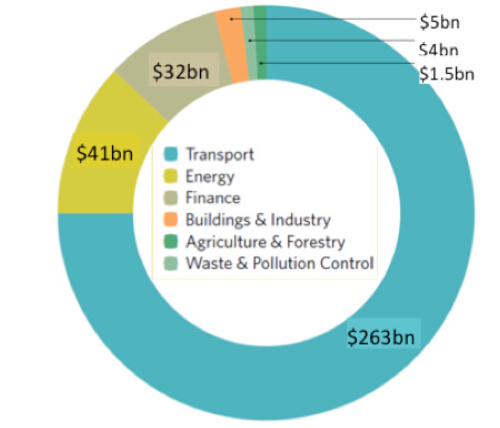

The climate-themed bond market stands at $346 billion as of March 2013. It is dominated by corporations in the transport theme, particularly railways, as well as renewable energy and nuclear issuers.

Thematic breakdown of $346 billion in climate-themed bonds in the global market

Source: Climate Bonds Initiative (2013)

Of the $346 billion, $163 billion of the bonds follow benchmark index-type rules for currencies, credit ratings and issuance sizes. China is home to the largest issuance of climate-themed bonds at $127 billion, 92 per cent of which are bonds issued by the previous Ministry of Railways with 8 per cent for renewable energy manufacturers and nuclear operators.

In the United States, Sweden and France, municipal green bonds have been issued where proceeds are ringfenced for green environmental programs.

A number of green banks have been established in recent years, from the U.K.’s Green Investment Bank and Australia’s Clean Energy Finance Corporation, to green banks in a number of U.S. states: the New York State Green bank, the Connecticut Energy Finance and Investment Authority (CEFIA) and the Californian Green Bank. These entities use state capital allocations to lend to clean energy and energy-efficiency projects; in some cases, they are either issuing green bonds or providing credit support for the issuance of commercial green bonds.