Setting the Tone

Beijing Review, February 19, 2014 Adjust font size:

China will neither tighten nor loosen its monetary policy in 2014

The People's Bank of China (PBOC), the country's central bank, said that it will continue to implement its prudent monetary policy and apply instruments in the coming months to keep liquidity at an appropriate level and achieve reasonable growth in credit and social financing in 2014.

Instruments including open market operations, changing the reserve requirement ratio, relending, and rediscounting will be adopted to manage liquidity in the banking system, according to a quarterly monetary policy report released by the central bank on February 8.

The central bank will carry out policy fine-tuning in a timely and appropriate manner to create a stable monetary environment for China's economic rebalancing and industrial upgrade. The fine-tuning will be combined with China's deepening reform to give the market a bigger role in allocating resources and to make financial markets better serve the real economy, said the report.

A retrospective

The broad measure of money supply (M2), which covers cash in circulation and all deposits, jumped 13.6 percent to 110.65 trillion yuan ($18.2 trillion) in 2013, a growth rate of 0.2 percentage point down compared with that of 2012, according to the data from the PBC.

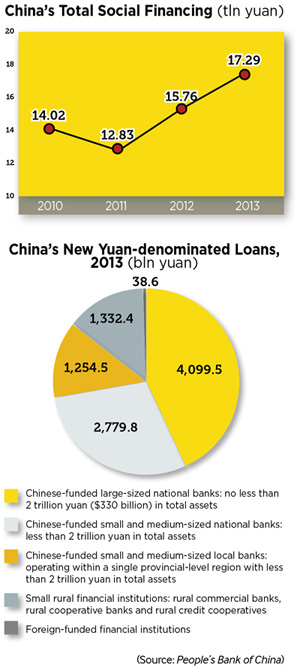

Total social financing, a measure of funds raised by entities in the real economy and a broad measure of liquidity in the economy in general, stood at 17.29 trillion yuan ($2.9 trillion) last year, up 1.53 trillion yuan ($252.3 billion) from a year previously and representing a record high. New yuan-denominated loans stood at 8.89 trillion yuan ($1.5 trillion) in 2013, accounting for 51.4 percent of the total social financing, the lowest amount in history.

Residential deposits at banks stood at 46.1 trillion yuan ($7.6 trillion) at the end of 2013, up 13.6 percent from 2012. However, the growth rate is 3.1 percentage points lower than in 2012, partly because flourishing online investment products have nibbled away at the total amount of money invested in traditional banks, said analysts.

Lending structure has been improved. A greater number of more accessible loans went to the weaker links of the economy in 2013, said Sheng Songcheng, Director of the Statistics and Analysis Department of the PBC, during a press conference held on January 15.

The loan growth rate hit 17.1 percent in the western region, higher than the 15.9 percent increase experienced in the central region and 11.9 percent in the eastern region.

Agriculture-related loans grew 18.4 percent in 2013, 4.5 percentage points higher than the average lending growth.

Commercial banks expanded lending to micro-sized and small enterprises last year. Out of 45 trillion yuan ($7.4 trillion) in loans to companies, lending to small and micro businesses hit 13 trillion yuan ($2.1 trillion), up 14.2 percent, higher than the average growth. Mid- and long-term loans for the service sector grew 13.7 percent in 2013, 11.5 percentage points higher than 2012, according to data from the central bank.

Off-balance-sheet financing saw a great surge in 2013, including trust loans, entrusted loans and undiscounted banker's acceptance bills, causing alarm to regulators. The three accounted for 29.9 percent of total social financing, up 7 percentage points on 2012. Analysts say interest rate marketization and shadow banking are major reasons for the rapid expansion of off-balance-sheet financing.

Despite China's abundant money supply and total social financing, the country's banking system experienced a severe credit crunch in June and December 2013.

In the report, the central bank attributed frequent occurrence of liquidity shortage to financial product innovations, rapidly growing debt financing, interest rate marketization and global capital flows.

Xie Taifeng, Dean of the School of Finance at the Capital University of Economics and Business, said the shortage is caused by fast expansion of interbank businesses and bank loans.

Interbank business has expanded too fast, leaving a large amount of money rotating only among banks instead of supporting the real economy, Xie said. "Interbank lending should only be used to solve banks' short-term cash shortage, instead of being a way to make profits."