Britain, China boost biz ties

China Daily, December 30, 2013 Adjust font size:

Inorganic approach

China Telecom (Europe) launched its mobile phone business in the UK last year with CTExcelbiz, a service that uses leased capacity on the network of Everything Everywhere, the joint venture of France Telecom SA and Deutsche Telekom AG.

CTExcelbiz has more than 10,000 clients in the UK and has since extended its services to France, Cao says.

Chinese companies that have taken the inorganic route, mostly through acquisitions of struggling British companies, are leveraging on their UK subsidiaries' technologies and research expertise to develop new products and markets.

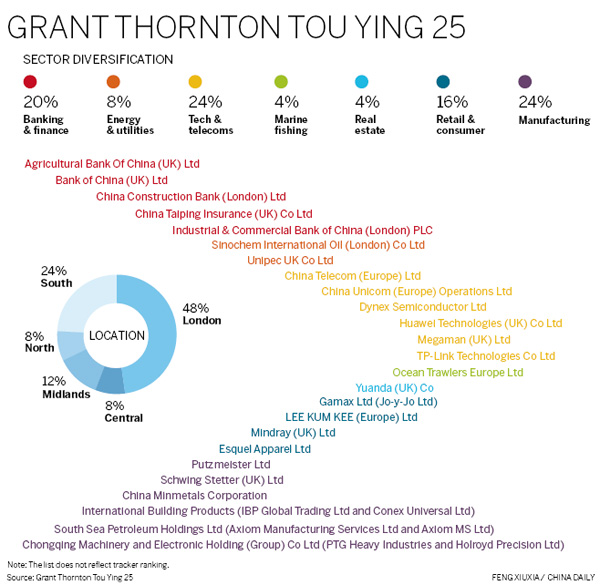

Zhou Xiaoming, minister counselor of the Chinese embassy in the UK, however, says that Chinese companies are now diversifying their investments in the UK, moving from traditional finance, trade and telecommunications to advanced manufacturing, infrastructure, branding and research and development.

Zhou says this diversification of the Sino-UK business relationship has promoted the growth of Chinese companies and helped them go global. It has also boosted growth and employment and helped aid British economic recovery.

In 2008, Zhuzhou CSR Times Electric, a Chinese company that makes train-borne electrical systems and electrical components, acquired Dynex Inc, a semiconductor manufacturer based in Lincoln, England.

After the acquisition, the Chinese company decided to invest 12 million pounds on a new research and development center in the UK and increased the R&D team strength from 12 to 40.

Dynex, on the other hand, helped Zhuzhou CSR build a new factory in China, which specializes in low-voltage IGBT semiconductors, while high voltage IGBT semiconductors are made in Lincoln.

"The strategy Zhuzhou CSR Times Electric Co Ltd discussed with us was to retain our operations in Lincoln," says Paul Taylor, who has been CEO of Dynex since 2004.

"They wanted us to grow. They want to invest in technologies and facilities we have here, so we would be able to become a leader in technology."

Dynex's team in Lincoln has grown from fewer than 250 before the acquisition to more than 330 now. The company's sales team in China has also grown after Zhuzhou CSR became a distributor of Dynex products in the Chinese market, Taylor says.

Other successful examples of Chinese M&A deals in the UK include China's Bright Food (Group) Co Ltd buying a majority stake in British cereal maker Weetabix Ltd last year and Shandong Yongtai Chemical Co acquiring majority ownership of British car parts maker Covpress Ltd in July.

Zhou, from the Chinese embassy in the UK, says that the new memorandum of understanding on civil nuclear power cooperation signed during the fifth China-UK Economic and Financial Dialogue in October in Beijing has opened a new chapter in bilateral cooperation.

"China is exploring opportunities for teaming up with Electrcite de France SA to build two nuclear reactors at the Hinkley Point site in southwest England," Zhou says.

According to Zhou, China and the UK are complementary economies. "Britain has abundant experience in the service and creative industries and technical innovation, while China, as an emerging market, offers capital and a large potential market," he says.

Zhou's views are echoed by Yao Shujie, head of the University of Nottingham's School of Contemporary Chinese Studies, who adds that one area of complementary strength is the UK's expertise in R&D and China's need for better products and technology, particularly in the advanced engineering and pharmaceutical sectors.

"What China has is a large market. For example, if a company invests 100 million pounds in R&D, it would need to sell lots of products to recoup the costs. Since China is a large market, this can be easily done," he says.

Currently many Chinese companies have R&D facilities in the UK. Companies such as Chang'an Automobile Group and Aviation Industry Corp of China have established R&D centers at the University of Nottingham's Science Park, to benefit from the university's research expertise.

Yao says that cash-flush Chinese enterprises have helped provide succor and capital to several ailing UK firms.

He says good examples include the potential Chinese investment in the UK's nuclear energy sector, and the recently announced Chinese investment in the Manchester Airport City project.

"Most of these are high-cost and high-risk projects. Chinese companies can invest with financial support from the China Development Bank, which gives them a great advantage," Yao says.