US-China challenges beyond 2015

chinausfocus.com by Dan Steinbock, December 17, 2013 Adjust font size:

In the near-term, Washington must manage austerity with pro-growth policies, even amid secular stagnation. In turn, Beijing seeks to manage local debt challenges with subdued but solid growth.

In both the United States and China, policy outcomes have far-reaching, global implications.

The U.S. budget deal: avoiding downside risks in 2014

After weeks of private talks, House and Senate negotiators, led by Sen. Patty Murray (D-WA) and Rep. Paul Ryan (R-WI), struck a budget agreement. The latter would replace $63 billion of the sequestration cuts slated for 2014-15 with alternative savings measures.

|

|

|

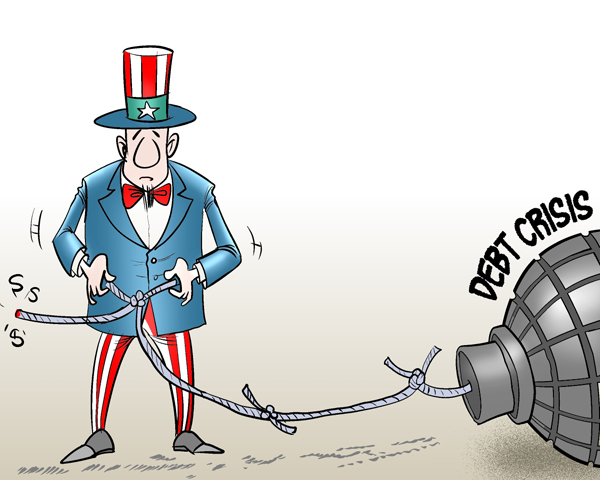

Tying the knots [By Jiao Haiyang/China.org.cn] |

The bipartisan objective was to surpass the 2011 budget-cutting law, particularly the automatic spending cuts (the so-called ‘sequester’), to avoid still another government shutdown and to ensure some stability to fiscal policy-making over the next two years.

In contrast to the once-hoped for “grand bargain,” the new plan is modest. While it was designed not to redesign the tax code and not to touch federal entitlement programs, it seeks to ensure more spending for domestic and defense programs in the short-term. The costs will be offset by embracing deficit-reduction measures over a decade.

But although the budget deal was promoted as a rare bipartisan breakthrough, it was neither rare nor a breakthrough. To defer the next debt crisis, Washington is resorting to still another timeout.

While 203,000 jobs were created in November, a robust recovery would require 200,000-300,000 new jobs per month. Further, unemployment rate remains 7 percent, while alternative unemployment, which includes both the unemployed and the under-employed, is still 13.2 percent.

Despite 45 months of private-sector job growth and half a decade of quantitative easing (QE), the labor force participation rate – those aged 16 and over who are working or actively looking for work – is 63 percent, the lowest since 1978.

Concurrently, the share of the population with a job has collapsed to 58.6 percent.

Most importantly, the budget deal, in its original form, leaves unaddressed the renewal of expanded unemployment benefits for the long-term unemployed. Indeed, the deal could cause 1.3 million Americans now receiving these benefits to receive none after Christmas, while 5 million jobless workers could be left in the lurch in 2014.

While Washington hopes that economic growth should quicken, annualized growth is likely to remain less than 2 percent in 2013 and at best around or above 2.5 percent in 2014-15.

Further, any premature tapering in the next 3-4 months could accelerate downside risks. Indeed, the Fed may not consider hiking rates until unemployment rate plunges to 6.5 percent, which is not likely to occur until late 2014. Consequently, the Fed may continue its third round of QE until March 2014, while record-low policy-rates could prevail well until the end of 2015.

The bipartisan budget deal is designed to avoid the downside risks – not to realize the upside potential.