ODI Set to Become More Diverse

China Daily, October 16, 2013 Adjust font size:

Chinese outbound investment will become more diverse in both target markets and fields in the coming year, according to a report released by global consulting firm Ernst & Young on Tuesday.

Going global is necessary for the sustainable development of Chinese companies, said the report, titled China Outbound Investment Trends and Prospects.

The firm forecast economic growth of 8 percent in 2014.

"As China's domestic economy reflects a slight recovery, Chinese capital inflows to developed and developing economies will increase simultaneously next year," said Fabian Wong, a partner in E&Y's China overseas investment department. Wong is in charge of businesses in the European, Middle East, Indian and African markets.

For the first eight months, China's non-financial overseas direct investment increased 18.5 percent year-on-year to US$56.5 billion, according to the Ministry of Commerce.

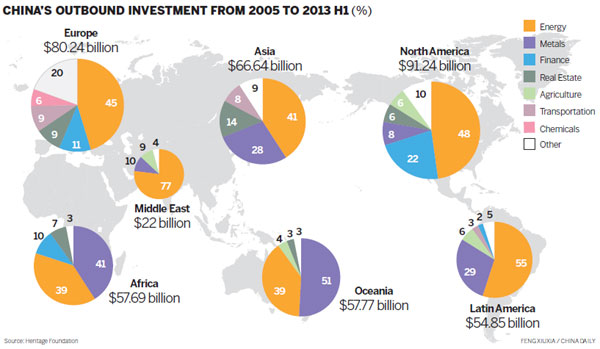

North America, Europe and Asia were the top destinations for China's outbound investment in the first half, the E&Y report shows.

Wong said that Chinese investors continue to reaffirm their interest in the European markets this year. That's especially true of the nation's State-owned enterprises, which have become the driving force in investment. Private-sector companies also have a strong appetite for fast-appreciating assets in the region, but they lack a clear focus in terms of strategy and execution.