Economic Ties Stabilize China-EU Relations

China Today by LI GANG, January 22, 2017 Adjust font size:

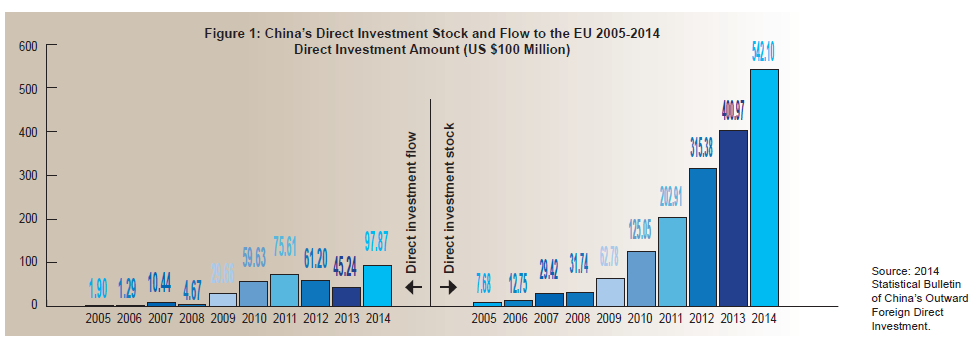

In the last few years, a new trend has appeared in bilateral investment ties; Chinese investment in the EU is fast gaining momentum. The 2014 Statistical Bulletin of China’s Outward Foreign Direct Investment shows that China’s direct investment stock in the EU rose nearly 71 times from 2005 to 2014 (see Figure 1). These statistics do not appear to have been updated by Eurostat since 2012. Despite small anomalies between Eurostat’s data and that of the COFDI bulletin, all numbers indicate an increase in Chinese investment in the EU.

In spite of this trend, some European countries are worried that mergers and acquisition by Chinese companies may drain their advanced technology resources and even threaten their national security. Misunderstandings and prejudice may partly explain why the EU has frequently imposed restrictions on Chinese investors. In fact, China’s investment in Europe is still in its initial phase, and makes up a rather small part of foreign investment in the EU. According to Eurostat data, U.S. direct investment stock in the EU stood at €1.54 trillion in 2012, accounting for nearly 40 percent of the direct investment stock that the EU has attracted from non-EU economies. China’s investment, however, formed less than one percent of the total, at €27.43 billion, and China’s direct investment in the EU is much smaller than that of the EU in China. In 2012, the EU directly invested €120.73 billion in China, which was 4.4 times that of China’s direct investment stock in the EU. Clearly Europe is not likely to be “occupied” by Chinese enterprises. Rather, it is hoped that Chinese investors will boost European economic recovery. China and the EU must uphold the principle of equality and mutual benefit in order to facilitate the stable growth of mutual investment, enhance bilateral investment treaty negotiations, and foster a favorable investment environment for both EU and Chinese businesses.

Meanwhile, financial cooperation between China and the EU continues to increase and highlights bilateral relations in economy and trade. As the scale of investment between China and Germany expands, both government and business leaders are committed to strengthening financial cooperation to meet the growing demand for payments in RMB, an inevitable outcome of the rapid growth of mutual trade and investment. In recent years, new deals have been made between China and Germany: a currency swap agreement was signed; Bank of China’s Frankfurt Branch was designated as a clearing bank for RMB; Germany gained RMB 80 billion as a qualified foreign institutional investor’s capital amount; and the China Europe International Exchange (CEINEX) was established. CEINEX satisfies both Chinese and German investors’ demands for RMB in financing and investment, bolsters internationalization of the RMB, and assisted in making Frankfurt the trading and pricing center for RMB assets.