How much tax to levy? There are no easy answers

China Daily, February 22, 2016 Adjust font size:

As China prepares a fresh round of tax cuts, economists are airing different views on how much the society is, or should be, paying to the government.

Economists call a country's total revenues from all sources its macro tax burden, measured as a proportion of GDP.

In China, however, "government revenue" is a tricky concept, given the complexity of the revenue stream.

China's fiscal budget consists of four separate accounts: general fiscal revenue (including taxes and fines), special-purpose governmental funds (including revenues from land sales), social security funds and returns from State-owned assets.

Measured by the narrowest definition - the revenue-to-GDP ratio - China's official tax burden is modest. In 2015 revenues totaled 15.22 trillion yuan ($2.4 trillion), or 22.5 percent of China's GDP, which is in line with the World Bank's 22 percent optimal ratio for upper-and middle-income countries.

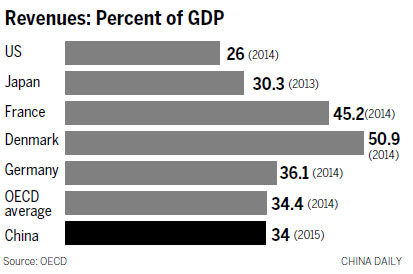

However, most economists agree that at least part of the special-purpose governmental funds, as well as social security payments, should be included as "revenue", because they are also levies on enterprises and households. The 34-nation Organization for Economic Co-operation and Development includes them when comparing the macro tax burdens of its members.

If land sales revenues are subtracted (economists dispute whether to include it), government revenue in China would be 29.1 percent of GDP. The Finance Ministry has adopted that interpretation, saying the International Monetary Fund doesn't count land sales as government revenue.

If all four accounts are combined, China's total government revenue in 2015 may have hit 23 trillion yuan, or 34 percent of GDP. It was down 1.7 percentage points from 2014, the first time in years the ratio has subsided.