Stalling Economic Growth in Emerging Europe and Central Asia

chinagate.cn, April 20, 2015 Adjust font size:

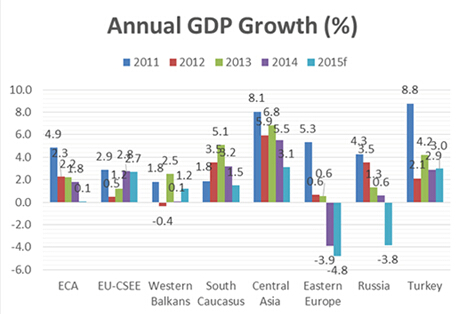

In the Emerging Europe and Central Asia (ECA) region, lower oil prices and the economic slowdown in Russia are weighing heavily on many economies in Eurasia, while countries in the Eurozone are benefiting from lower oil prices and a modest economic recovery. Overall, economic growth in ECA will be almost non-existent in 2015, down from 1.8 percent last year, the World Bank said during the 2015 World Bank/IMF Spring Meetings.

This drop in growth largely comes from a major slowdown in Russia, which is caused by lower oil prices and a sharp economic downturn. Not counting Russia, the rest of the region is expected to grow by 2.8 percent in 2015.

“Emerging Europe and Central Asia is expected to be the slowest growing region worldwide, with almost no growth forecast for 2015,” said Laura Tuck, Vice-President for the World Bank’s Emerging Europe and Central Asia region. “These low growth prospects are driven in large part by those countries in the eastern part of the region that are highly dependent on oil exports, or on trade and remittances from oil exporting countries, which are experiencing a slowdown. This is compounded by ongoing geopolitical tensions due to the conflict in Ukraine. Poor households are hit either directly because they receive fewer remittances, or indirectly because of the macroeconomic consequences, including higher import prices, the disappearance of jobs in construction and other non-tradable sectors, and potentially lower government transfers because of induced fiscal pressures. As a result, poverty rates are expected to rise.”

Tuck added that, “On the other hand, Central and South Eastern Europe and the Western Balkans – those countries that have close ties to the Eurozone – are benefitting from an increased pickup in net exports. The Eurozone is experiencing a nascent but modest recovery, with an expansionary monetary policy and declining oil prices, which is boosting consumer and business confidence.

Impacts of Falling Oil Prices and Geopolitical tensions

GDP growth in Russia was just 0.6 percent in 2014, compared to 3.5 percent in 2012 and 1.3 percent in 2013.

Looking ahead, the baseline scenario calls for a sharp recession in Russia, with a projected contraction of 3.8 percent in 2015 and 0.3 percent in 2016. This forecast is based on expectations of an ongoing slump in oil prices (oil prices remaining in the US$50-60 range) and no immediate resolution of geopolitical tensions.

The flexibility introduced into the exchange rate regime (the ruble has depreciated nearly 40 percent over the last year) has allowed the country to avoid a balance of payments crisis and has facilitated rebalancing of demand and production away from imports and toward domestic products and exports.

Countries in the South Caucasus, Eastern Europe, and Central Asia have been hard hit by the downturn in Russia and the oil price shock, directly and indirectly due to lower oil revenues, or a decline in remittances, and trade. Growth rates in 2015 are expected to be half those seen in 2014 in the South Caucasus and Central Asia, while Eastern Europe, which includes Ukraine, is expected to fall further into recession.