Investment in Fixed Assets for January to July 2014

chinagate.cn, October 15, 2014 Adjust font size:

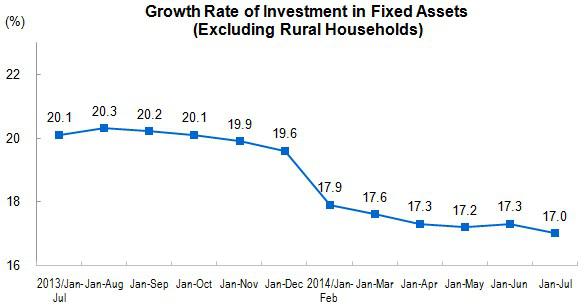

From January to July 2014, the investment in fixed assets (excluding rural households) reached 25,949.3 billion yuan, up by 17.0 percent year-on-year in nominal terms, dropped 0.3 percentage points over that in the first six months. In July, the investment in fixed assets (excluding rural households) increased 1.27 percent, month-on-month.

In term of different industries, from January to July, the investment in primary industry was 604.0 billion yuan, went up by 25.1 percent year-on-year, increased 1.0 percentage point over the first six months; that of secondary industry was 10,912.0 billion yuan, went up by 13.9 percent, down by 0.4 percentage points; that of tertiary industry was 14,433.3 billion yuan, went up by 19.2 percent, went down by 0.3 percentage points.

In secondary industry, the investment in industry reached 10,698.8 billion yuan, increased 13.9 percent year-on-year, down by 0.3 percentage points over the first six months. Of which, the investment in mining industry stood at 712.9 billion yuan, went up by 3.8 percent, down by 0.7 percentage points; that of manufacture, 8,860.0 billion yuan, increased 14.6 percent, down by 0.2 percentage points; that of production and supply of electric power, heat power, gas and water, 1,125.8 billion yuan, increased 15.2 percent, down by 1.0 percentage point.

In tertiary industry, the investment in infrastructure (excluding electricity) was 4,214.9 billion yuan, increased 25.0 percent year-on-year, down by 0.1 percentage point over that in the first six months. Of which, the investment in management of water conservancy increased 31.4 percent, down by 2.8 percentage points; that of management of public facilities increased 27.2 percent, up by 1.7 percentage points; that of transport via road increased 21.0 percent, down by 2.5 percentage points; that of transport via railway increased 19.6 percent, up by 5.4 percentage points.

In term of different areas, the investment in eastern region amounted to 12,206.7 billion yuan, rose by 15.9 percent year-on-year, dropped 0.4 percentage points over that in the first six months; that of central region, 7,256.4 billion yuan, surged 18.9 percent, down by 0.3 percentage points; that of western region, 6,426.4 billion yuan, increased 18.5 percent, decreased 0.1 percentage point.

In term of types of registration, the investment by domestic enterprises was 24,630.7 billion yuan, up by 17.9 percent year-on-year, dropped 0.4 percentage points over that in the first six months; investment by funds from Hong Kong, Macao and Taiwan was 623.4 billion yuan, up by 6.2 percent, increased 1.4 percentage points; and the investment by foreign funds was 595.0 billion yuan, down by 0.4 percent, while that increased 0.1 percent in the first six months

In terms of jurisdiction of project management, the central investment reached 1,168.9 billion yuan, increased 10.8 percent year-on-year, 3.8 percentage points lower over that in the first six months; while the local investment was 24.780.4 billion yuan, up by 17.3 percent, declined 0.2 percentage points.

Analysis on projects under construction or started this year showed that, the total planned investment in projects under construction reached 77,423.5 billion yuan, up by 13.1 percent year-on-year, decreased 1.4 percentage points over that in the first six months. The total planned investment in newly started projects was 23,039.8 billion yuan, up by 14.6 percent year-on-year, increased 1.0 percentage point.

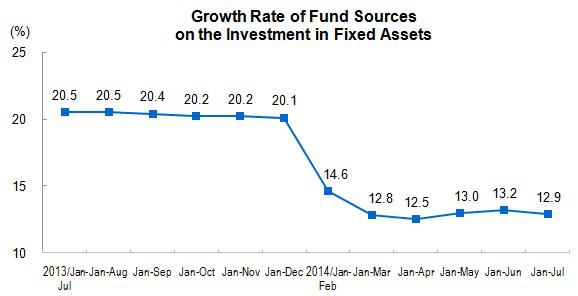

In terms of paid-in funds, from January to July, 29,273.4 billion yuan had been invested, rose by 12.9 percent year-on-year, 0.3 percentage points lower over that in the first six months. Of this total, the growth of government budgetary funds went up by 11.2 percent, decreased 4.3 percentage points over that in the first six months, investment from domestic loans went up by 12.7 percent, 0.2 percentage points decreased, that from self-raising funds went up by 16.6 percent, 0.1 percentage point decreased, that from foreign investment decreased 9.7 percent, and the pace of decline increased 1.4 percentage points, other investment dropped 2.1 percent, and the pace of decline increased 0.3 percentage points.

The growth rate of investment in fixed assets slightly dropped back. The first reason is that the real estate market has cooled significantly since this year, the real estate development enterprises are in strong wait-and-see mood, and more cautious about investment activities. According to preliminary calculations, the drop of growth rate of investment in real estate for January to July affects nearly 0.1 percentage point decrease in the overall investment growth rate. The second reason is that the prominent problem of excess capacity has affected the manufacturing investment enthusiasm. While the third reason is that the growth of investment funds source has been constrained by the slowing growth of local financial revenue, as well as the tighter supervision of financing platform. However, as the total planned investment in newly started projects picked up, the investment in fixed assets will maintain steady and rapid growth over the next few months.