Outbound Investment Unlikely to Outstrip FDI

Adjust font size:

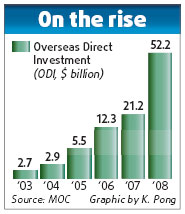

Despite a surge in Chinese overseas direct investment (ODI) in recent years, it is unlikely to outpace inbound foreign direct investment (FDI) this year, government officials and experts said on Wednesday.

Responding to recent forecasts by foreign banks and other organizations that ODI may overtake FDI, they said it is not likely to happen soon, at least not this year, partly due to Chinalco's US$19.5 billion failed bid last month to raise its stake in Rio Tinto, the world's third-largest mining company.

Even though Chinese National Petroleum Corp, joining hands with British energy giant BP, won the bid to develop Iraq's biggest oilfield on Tuesday, it may not significantly raise overall ODI this year because most deals signed in the past few months are "of small volume".

The Ministry of Commerce will hold a press conference this morning at the 13th China International Fair for Investment and Trade where it is expected to talk about ODI prospects.

"The truth is the number of ODI cases is rising, but the volume is still going down, as many cases are still small," said Chen Rongkai, a division director at the ministry.

In the first quarter, ODI cases grew by 7 percent to 445, but the volume was down by a big margin, according to Caijing magazine, which quoted ministry officials who did not reveal the figures. The first-half ODI figure is expected to be released soon.

The officials said the government would roll out policies to encourage ODI to leverage the opportunities generated amid the financial crisis.

Last month, the government said it would relax foreign exchange curbs from Aug 1 on firms wanting to invest abroad, with up to US$30 billion dollars expected to flow out.

And in March, the commerce ministry announced local governments had been given increased powers for approving ODI.

"There will be more such official measures to stimulate Chinese ODI," Chen said.

Considering that many foreign companies hurt by the economic recession are eager to sell assets and the growing keenness of Chinese companies on expanding overseas, many said this year would herald a wave of ODI flows. They forecast that it could even surpass FDI, which has contracted for eight consecutive months, a trend tipped to continue until early next year.

Standard Chartered Bank said in April that Chinese ODI could reach US$150-180 billion this year, way ahead of the projected US$80-100 billion in FDI.

Last year, Chinese ODI was US$52.1 billion, while FDI was US$92.4 billion, almost double.

Li Jianfeng, macro-economy analyst at Shanghai Securities, said: "It is impossible for FDI to be easily outstripped by ODI even though FDI growth is negative. ODI growth will be gradual."

Also, industry insiders said, Chinese companies planning large-scale overseas investments face protectionist and national security barriers set by governments.

For Li Jianfeng, "ODI is one way to relieve the growing pressure that China is under because of increasing foreign exchange reserves and to promote the internationalization of the yuan".

(China Daily July 2, 2009)