Big Miners Rattle Sabers Ahead of Talks

Adjust font size:

Global miners have upped the ante in their forthcoming negotiations with Chinese steel mills by seeking a 50 percent increase in the long-term contract iron ore prices for 2010-11.

The tough stance adopted by BHP Billiton, Rio Tinto and Vale could put further pressure on the sagging bottom lines of Chinese steel mills, said industry sources.

Rio Tinto has asked for a 50 percent hike over the 2009 benchmark price, while BHP wants the ore it supplies to some steel mills to be priced at spot rates. Vale on the other hand is keen on a flat 50 percent increase based on the difference between the spot price and the 2009 benchmark price, said an executive who heads the iron ore department of a large State-owned steel mill.

"Baosteel, which is leading this year's ore talks, would wait and see how Japanese and South Korean steel mills react to the proposal before taking a decision in this regard as they do not want to be blamed subsequently for the steep rates," said the source.

"If other Asian steel mills accept the new ore prices, then Chinese steel mills will have no other choice but to accept the same as stopping production is not in the best interests of the industry."

China failed to reach an agreement last year with BHP, Rio and Vale after China's chief negotiator, the China Iron and Steel Association, insisted on a 45 percent discount over 2008 prices, rather than the 33 percent cut accepted by other Asian steel mills.

Domestic steel mills subsequently turned to the spot markets for ore supplies and many mills signed individual contracts with the big three miners after accepting the 33 percent cut without making it public.

Industry analysts said steel mills would be forced to accept the 50 percent price hike, even though it may squeeze their profits further.

Official data shows that the average profit ratio of Chinese steel mills declined to 2.2 percent in 2009, down 53.4 percent from the previous year.

Chinese steel mills have always been disadvantaged in the annual iron ore price talks due to the low concentration of the industry and galloping demand.

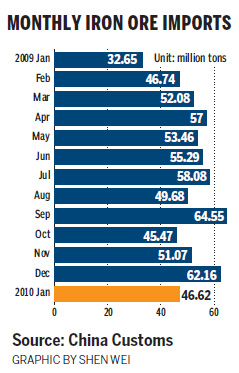

Steel output is expected to rise 8.6 percent this year to 621.5 million tons thanks to the government's 4 trillion yuan stimulus plan. Steel mills increased iron ore imports by 42 percent to a record 628 million tons last year, further boosting expectations of an increase in the annual contract prices.

Meanwhile spot iron ore prices surged to a record high this week, further complicating the negotiations.

Iron ore traders eye big prize China's iron-ore imports from South Africa, Ukraine, Canada up in 2009 Prices of 63.5 percent iron ore rose to an 18-month high at US$142 per ton including freight on Monday, more than double the benchmark prices settled in 2009.

Investment bank Morgan Stanley raised its forecast this week for 2010 prices to go up by 60 percent compared with a 20 percent increase earlier.

"Our company will feel the heat if this year's contract prices go up by 50 percent. We will be forced to increase delivery prices of steel products to offset the high raw material costs," said the managing director of a Jiangxi-based steel company. "It is not clear whether the market would digest the product price hikes as steel stocks are still high."

Steel stocks in 26 major Chinese cities rose to 15.86 million tons on February 22, up 51 percent from a year ago, according to data from Mysteel.com.

(China Daily March 4, 2010)