Looking for ODI Success Stories

Adjust font size:

Encouraged by the rollout of preferential national policies to promote outbound investments, Chinese enterprises are busy shopping for foreign mergers and acquisitions.

The question is whether this new enthusiasm will translate into the kind of success stories that will justify the strategy.

According to one survey by the China Council for the Promotion of International Trade earlier this year, only a third of the mergers and acquisitions by Chinese companies were considered successful.

"There have been few smart deals, as far as I know," said Thomas Chen, the China strategy director for Interbrand, an international brand consulting firm.

"The biggest problem is the majority (of entrepreneurs) have not decided what they expect to get from the deal. The offers are usually blind," Chen said.

Following this summer's reports that four Chinese businessmen will buy an unspecified stake in the French fashion company Pierre Cardin, analysts were quick to ask whether the buyers had the expertise to revive the luxury brand.

The purchase for an undisclosed price will allow the Chinese buyers to take over the brand and all business in China.

Following the news, a survey on Sina.com reported that 78.2 percent of Chinese consumers polled said they would not buy Pierre Cardin products after the takeover.

None of this has slowed outbound M&A activities by China's State-owned and privately owned enterprises.

New Jack Sewing Machine, a privately owned Chinese sewing machine provider from East China's Zhejiang province, took over two German sewing machine companies in mid-July at a cost of 45 million yuan.

The deal is China's first acquisition of overseas companies in the sewing machine sector.

The deal follows a series of firsts in other industries in recent months.

In early June, Tengzhong, a Chengdu-based industrial machinery maker, reached an agreement with General Motors Corp to buy the rights to its Hummer brand for an undisclosed price.

Suning Appliances, the country's leading electrical appliance retailer, announced in late June that it signed an agreement with Japanese electrical appliance retailer Laox.

Suning Appliances bought 27.36 percent of Laox's shares with an investment of $8.4 million, becoming its largest shareholder.

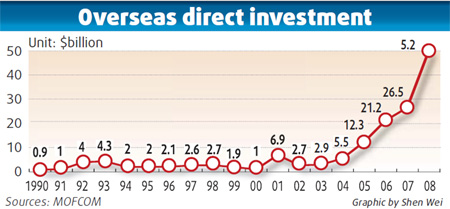

The growing interest in buying stakes in foreign companies is reflected in new statistics released by the Ministry of Commerce.

Through the end of June, overseas direct investment (ODI) surged by 43.5 percent year-on-year to 907 projects.

In May and June, the number of ODI deals totaled 547, up 173.5 percent from the same period last year.

Due to the unexpected failure in bidding for the Chinalco deal, the ODI in the non-financial sector by volume dropped by 51.7 percent from a year earlier to US$12.4 billion.

In early June, Chinalco confirmed the collapse of the deal to invest US$19.5 billion in Australia's Rio Tinto, the world's third-largest mining company.