Once Bitten, Twice Not Shy

Adjust font size:

Few companies have had such inauspicious beginnings as China Investment Corporation (CIC), China's first sovereign wealth fund, backed by the world's largest foreign exchange reserves.

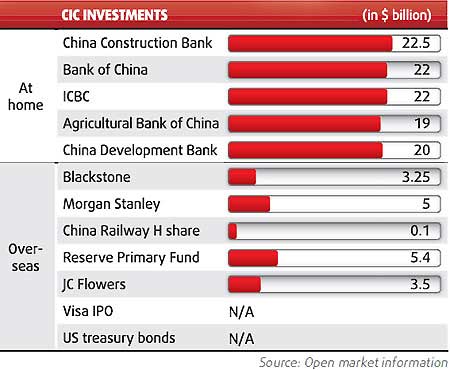

Seventeen months ago the US$200-billion fund had a lavish inaugural ceremony in Beijing and immediately started investing in some of the hottest names on Wall Street, including US$5 billion in Morgan Stanley and US$3 billion in then-celebrated hedge fund Blackstone.

But the investments soured and billions were lost in the global financial tsunami and questions over CIC's operational skills mounted among the Chinese public. CIC chairman Lou Jiwei admitted in a January forum in Hong Kong he "dare not" invest in any foreign financial institution in the light of the uncertain market climate.

But CIC is not passively biding time until the financial fallout blows over. Market observers said there are signs the Chinese sovereign fund is shifting its focus from troublesome financial assets to some cash-strapped industries, such as energy, raw materials and hi-tech manufacturing, as the global financial crisis deepens.

Fortescue Metals Group Ltd, Australia's third-largest iron ore exporter, has confirmed last week it had talks with CIC and Anglo American Plc on "investment opportunities."

CIC is also joining a bid for International Lease Finance, the debt-ridden aircraft-leasing unit of American International Group (AIG). Other bidders include sovereign funds such as Dubai's investment arm Istithmar World and the Kuwait Investment Authority and private equity firms such as Kohlberg Kravis Roberts, TPG Capital and the Carlyle Group.

"Sovereign wealth fund used to have a hard time getting access to certain sectors in foreign countries, for various political and commercial reasons," said Yang Ruilong, head of the college of economics at Beijing's Renmin University. "But now such action might be easier as increasingly capital-hungry businesses get caught in the global economic downturn."