Land Auction Sizzles with Record Bid

Adjust font size:

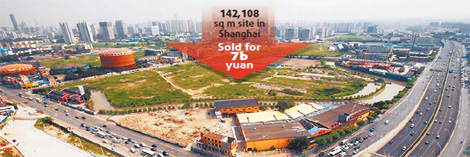

An auction for a prime plot of land in Shanghai attracted heavy bidding and a record price on Thursday.

The 142,108-sq-m site in the Putuo district of Shanghai, with an estimated gross floor area of 312.637 sq m, was sold to Hong Kong-listed China Overseas Land & Investment for 7 billion yuan, or 22,409 yuan per sq m floor space.

The plot in the Changfeng area drew dozens of property developers from home and abroad, including Greentown, Shanghai-listed Poly Real Estate, Singaporean Yanlord, and Shenzhen-based China Overseas Land.

Eventually, China Overseas Land, a subsidiary of China State Construction Engineering Corp, China's biggest home builder that went public this July, outbid high-profile Greentown China Holdings Ltd's last offer by more than 500 million yuan and bagged the site for more than twice the listed price of 3.058 billion yuan.

Soaring land value is making a comeback in China's real estate market, analysts said. Last July, when property developers were hit hardest by the credit crunch, part of the plot was listed at 1.6 billion yuan but found no bidders. However, only 14 months later, the expanded plot became the focus of great interest.

Many market observers did expect a new "land king" from the auction, especially after Zhejiang-based Greentown raised its offer to 5.628 billion yuan one day before bidding began in earnest. That means, the final land value will be no lower than 18,000 yuan per sq m floor space, exceeding the previous 14,500 yuan record set in Beijing.

China Overseas Land was determined to secure the land, backed by ample credit and optimism over Shanghai's land market, according to Xue Jianxiong, an analyst with E-House (China) Holdings Ltd.

He said developers took advantage of the government's fiscal boost to borrow money and reinvest it.

He also said clever marketing and advertising by Poly in Shanghai's Gucun area of Baoshan district showed State-owned developers how to make money from less attractive land.

China Overseas Land's bidding confidence also came from its brilliant sales performance this year and solid support from its parent company. In the first half, China Overseas Land posted a 32 percent rise in net profit amid robust property sales. Its parent company China State Construction Engineering Corp, which raised a total of 50.16 billion yuan from last month's initial public offering in Shanghai, had reportedly allocated 8 billion yuan to the listed arm for "future development".

Domestic realty players have been chasing prime plots in the last few months. A site in Beijing's central business district (CBD) area was sold for 4.06 billion yuan, or 14,500 yuan per sq m, to Franshion Properties (China), a subsidiary of Sinochem Group, at the end of June. In July, Gemdale Corp shelled out 3.05 billion yuan for a suburban plot in Shanghai's Qingpu district, equivalent to 14,495 yuan per sq m.

Relentlessly soaring prices also dashing the hopes of many potential home buyers, especially those waiting to marry.

(China Daily September 11, 2009)