New Loans May Reach 6.5 Tln Yuan in H1

Adjust font size:

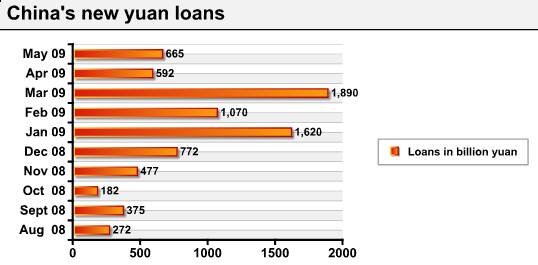

China's new yuan loans in the first 20 days in June exceeded that of the same period in May, making it possible that new loans may reach 6.5 trillion yuan (US$951 billion) in the first half of 2009, Shanghai Securities News reported, citing anonymous authoritative source.

According to the source, banks also tend to expand their credit line when the month is ending, which makes it almost certain that new loans in June will exceed that of May and that the 6.5-trillion expectation will come true, considering the current trend for the new loans increase.

Lian Ping, the chief economist with Bank of Communications, said that the trend of the quarter-end loans increase was one reason for the big increase of June's new loans, and the increase of newly-commenced projects, which needed a lot of money, was another.

China's new yuan loans had seen a sharp increase since the beginning of the year, surging to 5.83 trillion yuan in the first five months, despite the decrease compared with the first three months, Lian said, adding that it was very likely for June to recreate an increasing trend.

According to a bank branch, which was not named by Shanghai Securities News, it had run short of the whole year's credit quota as early as April and its superior had already approved to increase its credit quota earlier this month.

"We have made a lot of new loans in June and since many infrastructure construction projects which were delayed by a shortage of capital are set in motion, new loans will be further increased," staff of the branch told the paper.

The state council, or the cabinet, slashed the minimum capital requirements for fixed-asset investment projects at the end of last month, lowering the threshold of infrastructure construction projects and increasing the demand for loans.

The country's four major state-owned banks -- Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China and China Construction Bank, had a smaller contribution to the new loans than before compared with that of municipal commercial banks, with the figure accounting for 33.93 percent of financial institutions' total new loans in May, lower than 40 percent for two consecutive months.

(chinadaily.com.cn June 22, 2009)