CPI and PPI Fall, But Deflation Threat Eases

Adjust font size:

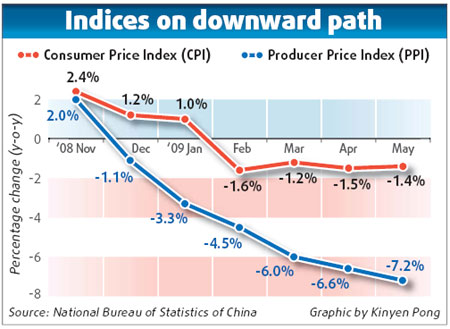

Consumer and producer price indices continued to fall in May despite recent rises in commodity prices, but analysts say both the indices are likely to register positive growth in the second half of the year and the threat of inflation may loom next year.

The consumer price index (CPI) fell 1.4 percent in May from a year earlier, the National Bureau of Statistics said yesterday. The producer price index (PPI), which monitors factory-gate price changes, also dropped at an annualized rate of 7.2 percent.

Since the outbreak of the financial crisis, economists have fretted that the nation may have to battle with deflation - which features a prolonged period of price declines, economic contraction and slow credit growth.

Given that scenario, consumers tend to skip unnecessary purchases while businesses are likely to delay investments, denting demand and delaying an economic recovery.

Although the CPI and the PPI remain in negative territory, analysts said the threat of deflation is not as high as at the end of last year.

"Concerns about deflation are receding as global commodity prices rise and economic indicators generally point to improving fundamentals," said Jing Ulrich, managing director and chairman of China Equities at JP Morgan.

According to the composite leading indicators (CLI) released by the Organisation for Economic Co-operation and Development (OECD) on Tuesday, most of the major economies are close to emerging from recession and a recovery is possible by the end of the year.

The CLI seeks to identify turning points in the economic cycle about six months in advance. China's CLI rose to 94.3 in April from 93.4 in March and represented the third consecutive monthly rise.

Sun Mingchun, economist with Nomura International, said the data implies that China's GDP growth may expand to 10 percent in the fourth quarter from a year earlier, up from 6.1 percent in the first quarter.

"As last year's high base elapses, deflation should begin to moderate in the coming months and turn into mild inflation in the second half," Ulrich said.

Some economists say the rapid growth in liquidity, at home and abroad, would also help fan inflation and there are already signs of that.

"There is a high possibility that the Chinese and global economies have to deal with stagflation - an inflationary period accompanied by rising unemployment and lack of growth in consumer demand and business activity - in the future," the State Information Center, a government think-tank, warned in a report released yesterday.

"China should prepare for the risk of inflation bouncing back faster than economic growth."