China's Bank Loans See Striking Rise in January

Adjust font size:

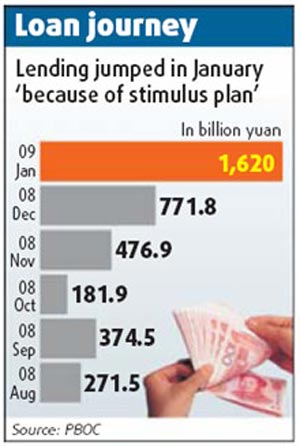

Chinese banks issued 1.62 trillion yuan (US$237 billion) in new loans in January, up 101 percent year-on-year, prompting some economists to say the government might not cut interest rates for the time being to boost the economy.

The massive jump in lending is equal to about one-third of the loans issued in the whole of 2008, a year that began on a generally tight credit line, the central bank said yesterday.

M2, which includes cash and all types of deposits and indicates overall liquidity in the financial system, grew in January, too, by 18.8 percent year-on-year. It increased 17.8 percent in December.

|

|

Chinese banks issued 1.62 trillion yuan (US$237 billion) in new loans in January, up 101 percent year-on-year. [China Daily] |

The government announced a US$586-billion package on November 9 to boost domestic demand and shore up investment. Though the central government will shoulder one-third of the cost, banks will play an important role in financing the construction of bridges, railways and highways.

"The banks are fighting for the best projects in the government's stimulus package," said Ha Jiming, chief economist of China International Capital Corp. "It's not surprising to see that an array of the deals were sealed in the past month."

"The massive lending growth minimizes the need to further cut interest rates heftily," said Lian Ping, chief economist with Bank of Communications. "The liquidity problem should ease with such a growth."